How To Set Up A Us Bank Account From Overseas

The good old United states of america of A. Maybe y'all are a frequent traveler there, looking for a practical way to practice concern there, or y'all are an American that lives away and needs a convenient way to avert high international fees. Whatever your reasons, opening a bank account in the globe's largest economy can come with many benefits, although, if y'all are a not-resident, you might face several challenges if you don't know exactly where to await!

Despite existence a very technologically advanced land, the US banking world is known for nevertheless being rather sometime school. Not just do they carry hefty foreign transaction fees and aren't especially multi-currency friendly, only online cyberbanking can as well leave a lot to exist desired. The majority of banks rely heavily on contiguous interaction (including some instances when your account gets all of a sudden locked), and even accessing your bank from away sends up an immediate red flag for many - definitely a less than ideal state of affairs for a global citizen, digital nomad, or international entrepreneur.

In fact, I remember the days where I had to visit my US bank co-operative every time I was going abroad to relay my whole travel itinerary so that they wouldn't decide to block my 'suspicious' activeness and get out me penniless on my trip (and in one example, they still blocked it anyways 🙄)

However, there is no demand to feel disheartened. While this tin happen in some circumstances, a large portion of U.s. banks are increasingly foreigner-friendly, and contrary to conventionalities, many will now allow y'all to open US depository financial institution accounts without a social security number!

Table of Contents ↺

- What y'all volition need

- Preparation is cardinal

- Opening a personal account

- Recommendations for personal accounts

- Wise Borderless

- Charles Schwab

- Chase Personal

- Bank of America

- Opening a business business relationship

- Recommendations for business accounts

- Wise Business

- Mercury

- Chase Business

- Citibank

- FAQs

What you will need

Commencement of all, it'due south important to understand the diverse banking landscape in the US. You have probably heard some of the big names like Bank of America, but at that place are too many regional and state-specific banks, credit unions, online banks, and investment banks. As a not-resident, we would recommend looking towards the bigger banks similar Chase Banking concern, Banking concern of America, or Citibank. To our noesis, they are all open to not-residents. Smaller and more local banks accept a lower risk threshold and will likely plow yous away if you don't accept a U.s.a. address.

On top of that, the required documents you need to submit in order to open an account vary depending on the bank, state, or fifty-fifty branch. However, US residents volition generally exist asked to submit the following for a personal checking account:

- Social Security Number (SSN) or Private Tax Identification Number (ITIN)

- Passport or ID

- United states Accost and proof of address (i.e a utility pecker)

- Minimum deposit

- In some cases, a U.s. phone number to access online cyberbanking

When the banks are dealing with non-residents, they volition be looking for something to compensate for these documents in some fashion, and then they can be certain to open an business relationship while fulfilling all KYC and AML requirements.

If yous are a Us citizen living abroad, this should naturally exist relatively easy to provide. For the US address, you lot can either use a shut relatives' or a postal service forwarding service (although banks accept started to become picky well-nigh these in recent years so an actual residential accost is preferred). Any of the major banks, likewise as several online banks such equally Marry Bank, Charles Schwab, and Majuscule One, will let you annals remotely (only perhaps apply a VPN and don't tell them you alive abroad!)

As for everyone else, depending on whether you want to do this remotely, in person, or you lot are looking to ready a business account, at that place may be some additional steps and requirements, likewise as other options y'all should probably consider. We hope that with this article, we tin can help you notice the best solution for you.

Grooming is primal

Thus, due to the always-changing nature of banking policies, it's crucial to prepare before approaching the banks. Call back in advance to check the requirements. Make sure to verify:

- Practice I need an ITIN or SSN?

- Do I need a Us Address? What kind of proof do you need?

- What'southward the minimum deposit?

- Do I need to prove my source of funds somehow?

- Volition you lot accept this document?

It is vital to note that if you don't properly inquiry this and just caput direct to the bank, you may even become disqualified to employ at that bank over again.

Also, if you are going in person, nosotros recommend finding a branch that is used to dealing with non-resident requests. If yous walk into any onetime co-operative, some of the tellers may not be fully trained in dealing with these issues and will deem information technology non possible.

Now hopefully, we haven't scared you lot away with this warning, believe me, many people earlier you have managed successfully. However, if after the preparation you lot are still unsure, and specially if a trip to the Usa is off the cards and yous are looking to do this remotely, we recommend seeking professional person help from a specialty service dealing with not-resident banking.

❗ Beware, many services volition say they can get you a US bank account every bit a non-resident without an SSN, but a lot of them are scams and may be attempting to deceive you or pursue information technology through illegal means.

Nosotros can personally vouch for Global Banks, after hearing success stories from our ain contacts. Global Banks are e'er kept up to speed with all the latest policies and should be able to assist y'all detect a suitable bank in the US through their contacts.

Delight also be enlightened that if you intend to get a bank business relationship without an SSN or ITIN, the minimum eolith may be a lot college than usual, sometimes even above $10,000.

Opening a Personal Account

First of all, if you don't take an SSN, having an ITIN will enormously amend your chances when applying for a US banking company account. Nigh major banks also equally others will have ITINs. Alliant Credit Union for case, welcomes remote account openings from non-residents if they have an ITIN.

An ITIN is a blazon of tax identification that the IRS uses to document non-residents for tax purposes. The process is quite complicated and will crave y'all to have some kind of connection to the U.s., due to which you have to file tax returns in the US. You can find info on which non-residents are required to file a tax render on the IRS website. Also, it may be worth checking out IRS Certified Credence Agents (CAA) to help you lot become an ITIN.

We have been thinking of writing a more in-depth article virtually how to get an ITIN for non-residents in the near future, so if you lot are interested, sign up for our newsletter and we'll permit yous know when information technology'due south ready!

If you don't feel similar heading downward the ITIN path, contrary to popular conventionalities it is still possible to open a non-resident account without an SSN or ITIN, only it is not a total guarantee. It depends significantly on having the right banking connections along with several considerations such as nationality, taxation residency, (blacklisted passports and citizens and residents in countries which the US has sanctions confronting volition have a much harder time), and your source of income.

Unfortunately, the list of possible banks is non evergreen. Yous tin pretty much guarantee that you volition have an easier time with most of the more prominent brick and mortar banks since they are more than used to dealing with non-resident clients. The rules are constantly changing, so the required documents needed can vary past bank, state or even branch in some cases.

1 bank that may not require a social security number may change its mind in a month'south time. Have COVID for example, with travel condign increasingly tricky, many banks became more flexible to prepare up an account remotely, because that information technology is non as easy to visit the US in person.

Recommendations for Personal Accounts

Wise Borderless

Wise, or Transferwise equally it was formerly known, is the pioneer of borderless banking. It started as a way to transport money abroad without large substitution fees and long waiting times by sending it between their own international branches. It has since become a major player and competition to traditional banks, assuasive you to open up borderless banking concern accounts in several countries, including the US, and currency wallets for over 50 countries.

Depending on your reason for needing a U.s. business relationship, you might want to consider Wise or whatsoever of the other nifty fintech options available. Of course, it really depends on your reason for needing a United states account. While fintech services are a good selection for quick transactional banking, it's probably ameliorate to salve it for supplementary use and not to store big quantities of money. Overall, it all depends on your reasons for opening an business relationship. Nearly people looking for a U.s. personal account will find that Wise is an easy and reliable solution to satisfy their banking needs. If your reasons are more complex, you might desire to consider a brick-and-mortar option instead.

Wise at a glance

Highlights

Charles Schwab

Nosotros've covered Charles Schwab before, and it has to be the #one The states bank for digital nomads. And you tin can run into why, because they take no strange transfer fees and refundable fees on foreign ATM withdrawals. They also take no monthly or almanac fees. They besides claim you can open an account with them in 10 minutes online. These features all get in very bonny for digital nomads and frequent travelers.

The flip side however is that they don't open their standard accounts for non-residents (but come across below for information about their international accounts). Even if you are a US-citizen living abroad, information technology'due south probably best not to mention it. If you lot have a US accost you lot tin can use, combined with a VPN, even so, it should be ok. For non-residents, at that place are mail forwarding services out in that location that tin have care of this part for a depression monthly fee. As an alternative, they have an international account option which doesn't require an SSN, ITIN, or United states address, and even comes with a debit card. The caveat to this option is that information technology requires an initial $25,000 deposit to open.

Finally, if you are looking for a practiced Usa investment option, Charles Schwab besides offers brokerage accounts for individuals in over 100 countries and because they are primarily an investment bank, they have higher involvement rates than some other banks on the list at 0.05%

Charles Schwab at a glance

Highlights

Chase Personal

We've heard positive things virtually not-residents opening accounts with Hunt. Their simple requirements go far quite favorable on this list, as they only need some kind of tax identification number - either an SSN, ITIN, or EIN, and an ID which can exist simply a passport. Hunt is a pretty mutual choice for Americans, and you will detect their ATMs all across the US.

Their fees are pretty standard for a large bank. In that location is no minimum opening deposit and their monthly fees are $12 per month for the near basic plan, $25 for their premium and Sapphire accounts. The fee can exist waived if you maintain a sure balance (depending on the programme), and for the basic program, information technology is also waivable if y'all have $500 or more than in monthly straight deposits. Something to bear in mind is their foreign transaction fees, which are normally around ii-5% of the entire purchase. Also, their savings accounts' interest rate is currently 0.01%, which is definitely not the all-time you can find.

Hunt at a glance

Bank of America

Bank of America will by and large let you to open an business relationship as a not-resident for both personal and concern employ if y'all oftentimes visit the US for work or studying, even so, they will require you to see them in person. It depends, only it is known to exist one of the most foreigner-friendly on the list. However, if you want access to internet cyberbanking, y'all will need a tax identification number (like with Chase). Fees and conditions besides vary depending on the state in which y'all apply with Banking concern of America, but monthly maintenance fees and minimum opening deposits are very low for all of their options. Foreign transaction fees are three%, but they have many international partner ATMs which will aid you avoid extra withdrawal fees when taking out greenbacks abroad.

Bank of America at a glance

Opening a Business Account

For a business business relationship, you will nearly likely need to set up an LLC in the US. It's a fairly painless process that tin be done in just a few minutes online. Going the LLC route is definitely the most comfortable style, every bit it is doubtful that yous will manage to open a United states bank account as a strange entity.

While not impossible, yous need to evidence a long track record of a business connectedness to the United states of america, a lot of money to deposit, and mayhap fifty-fifty a personal history with the banking concern. Once you accept an LLC, the good news is opening a bank business relationship is also rather simple to do, even remotely.

When choosing which land to file your LLC, most people cull either Delaware, Wyoming, New Mexico, or Nevada. These four do not accept any country taxes and offer the most foreigner-friendly business concern laws. If nosotros could cull one for digital nomads, it would be New Mexico. They offer a combination of favorable privacy laws, low costs, no tax on not-resident companies, and no annual reports or fees. In one case you have set this up, you lot also need to apply for an EIN (Employee Identification Number) a.one thousand.a your LLC'southward taxation number. For more detailed info on the procedure to get an LLC, check out the FAQ section below.

With brick and mortar banks, the response you might get to opening a non-resident account volition vary. It's possible that many will ask you about your connectedness to the U.s.a. market, and if you have offices there. Perchance they volition require a considerable eolith which might simply non be an option for you as well. There are lots of deciding factors to exist taken into account and you will likely take to visit a branch in person at some point. Here are our acme choices, but call up, preparation is central and it'southward worth a phone call before booking a trip to the States. Y'all can likewise consult Global Banks for professional advice on business accounts as well.

Like with personal accounts, nosotros recommend Wise for business concern also. At that place are many corking fintech options in our commodity on the best business concern bank accounts to open from anywhere.

Recommendations for Business Accounts

Wise Business

In addition to supporting personal accounts, there is as well Wise Business, which volition give y'all college transfer amounts while still keeping exchange rates at 0.5%. For both personal and business utilise yous volition as well go your own debit card linked to your account. It's definitely a skillful solution if you have less complex needs and need an easy no-frills way to send and receive coin from the United states of america without being a resident or opening up a resident LLC for your business.

Wise Business at a glance

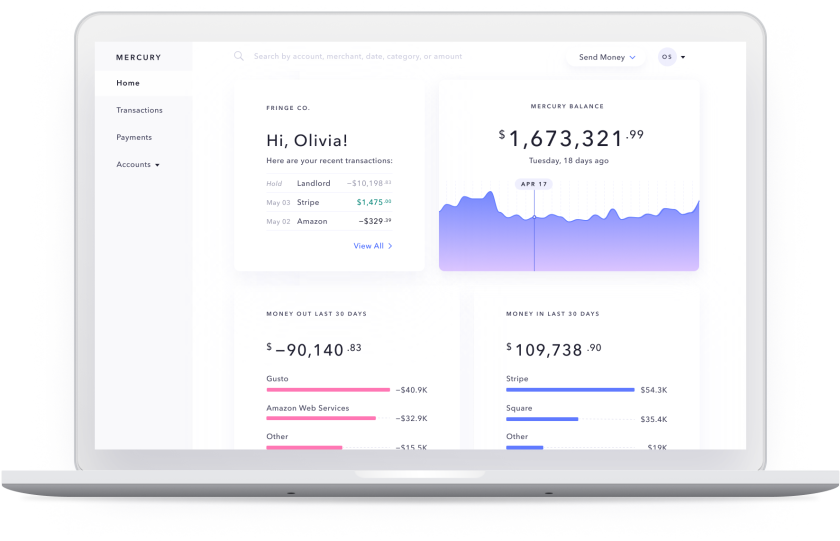

Mercury

Mercury is another one nosotros take featured before and we highly recommend it for United states banking. It is a US product that was congenital as a banking solution for tech start-ups. With Mercury, you volition need to ready an LLC, simply the skillful news is that you don't need to be physically in the United States to set up up a business account with them, as y'all can do it from almost anywhere except a few sanctioned countries.

To be honest, since the United states is the focus here, the ease Mercury provides for LLCs together with the low fees, loftier interest rates, and the multi-currency access that Wise gives makes it without a doubt the best choice when information technology comes to setting up a The states business account remotely.

Mercury at a glance

Chase Business

Chase for Business organization is a great selection for concern big and minor, and one of the most well known banks in the Us. You won't be able to open up your business relationship fully remotely (exceptions may be made during the pandemic depending on your business book and whether you have an ITIN or SSN), yet virtually of the initial piece of work can be washed online. We recommend them because you only demand a minimum of a $2,000 daily balance to avoid the $15 fee, which is relatively low compared to the general The states market. They also have quite a large option of business credit cards with all sorts of travel rewards. As mentioned earlier, Chase is also a dandy option for non-resident personal accounts, and it'south also quite easy to link them together if you wish.

Chase Business at a glance

Citibank

Citibank is another slap-up option for businesses, also letting y'all open a company account with your LLC. If y'all are CitiGold customer, or at the very least, have a Citi account from another developed country (such every bit Hong Kong or Singapore), it'southward possible to practice this remotely as well. Bear in heed, however, that the minimum deposit for doing things remotely is $fifteen,000, then depending on your restraints, it might be more worth it to go on a trip to the states instead to sort it.

Information technology is a very international bank with around 700 branches in the United states of america and over 1800 branches overseas in 160+ countries, and there are suitable plans for both small and big businesses, starting with their most basic business relationship, CitiBusiness Streamlined. In this one, you can not make more than 250 transactions per month and the monthly fees are $15 per month, which can be waived if you maintain a $5000 account balance. Their programme for larger businesses has no limit on monthly transactions just the monthly fee is increased to $22 per calendar month. Overall the involvement rates on their business organization accounts are more than favorable than Hunt at 0.05%. Foreign transaction fees are up to iii%.

Citibank at a glance

Frequently Asked Questions

FAQs ↺

- What are the advantages and disadvantages of having a US Banking company account?

- How practise I get a US credit card?

- What are the tax implications of having a non-resident business relationship?

- What do I need to form an LLC?

- Practice I need a The states accost?

What are the advantages and disadvantages of having a US Bank account?

Let's start with the pro'due south 👍

With the US dollar existence the world's cyberbanking currency, and the country of the free being a credible land worldwide, it brings a lot of international leverage. Since there is a high degree of trust for transfers coming from US accounts, United states banking is very smoothen and efficient and will non receive the aforementioned amount of scrutiny as bank accounts from some countries.

In improver, the Us does not provide whatever info to other countries nearly their taxpayers, meaning you tin can enjoy a great deal of privacy with a Us bank account. The funny affair is, the The states expects other countries to share this information regarding US taxpayers away - that's the kind of negotiation power the United states of america dollar has.

On the other hand 👎

Remember 2008? Their higher risk tolerance is what makes the U.s.a. a convenient place to bank, yet information technology too means the US has the highest rate of bank failures in the developed globe. It's just something to bear in mind if y'all are thinking of putting all your life savings in a US bank account.

On height of that, it is very US dollar-centric and the fees for foreign transactions tin can sometimes be rather exorbitant if you are not careful. If y'all are going to be dealing with unlike currencies frequently, it is best to endeavor out the fintech options instead (or a combination of both perhaps)

How practise I become a US credit card?

Chances are, many who are looking for a US depository financial institution account desire a US credit card, which offers some of the all-time reward rates in the world. Having no SSN in the US tin brand things challenging, merely there are still options. Many major carte issuers such as Bank of America, American Express, Hunt, and Uppercase Ane will accept you if you have an ITIN. Without an ITIN, you take little take chances of getting approved.

The other important hurdle for getting a US credit card is proving a strong United states of america credit history. Unfortunately, the most common credit bureaus do non monitor international credit history, so unless you exercise have some US credit history, yous are probably not going to become the platinum! For that, it is all-time to look offset at large international banks similar HSBC, which will often take into consideration your credit history away and will let you sign up for a US credit card with no prior history.

If you accept no U.s. credit history, your all-time bet is to go an ITIN, sign up for a banking concern like Bank of America and after some fourth dimension request a secured credit carte du jour. Afterward almost a year of responsible spending and on-time payments yous'll likely accept a good enough credit history to qualify for more interesting unsecured credit cards.

What are the tax implications of having a not-resident business relationship?

If you are a so-called "US person for tax reasons", you are probably subjected to citizenship-based tax already and required to submit a US tax return. For those who are not citizens or a 'U.s. person for tax reasons, you will only be subject area to taxes on any US income or income "effectively connected with a US trade or business" i.eastward you accept a physical US performance with employees, premises, or other concrete assets. Not-resident LLCs volition require you lot to file an almanac "informational render" to the IRS, merely over again you volition only pay taxes in relation to any US trade or income (for instance if you have employees or contractors in the United states).

Not-residents are exempt from paying any revenue enhancement on the interest you lot may receive from bank deposits, savings & loan institutions, credit unions, insurance companies, or portfolio interest. The same applies in that you are only exempt if at that place is no connection to any Usa merchandise or business.

What practice I need to class an LLC?

Outset of all, a proper noun that complies with the rules in the state y'all are registering. Different states have dissimilar rules on how you tin can proper name your LLC. Then you will need to file the "Articles of Arrangement" which can be done online very easily. Next, appoint a registered agent who will accept all legal and other concern mail on the LLC's behalf. This is a person who has a physical accost registered in the state of your LLC, but at that place are numerous private service companies who will do this for you for a fee. And so, you must apply for an EIN on the IRS website. You lot must do this even if your LLC has no employees.

Do I need a United states of america address?

You should clarify with the bank if they are afterwards a physical The states accost where you lot can live or a postal accost. US banking relies a lot on sending mail (for instance when you lot are waiting to receive your bill of fare) so for many banks, a postal accost or PO box should exist enough. Withal, some might be looking for proof that you alive at the address (e.g. your phone bill) so it's of import to check, as this will determine if the depository financial institution is uniform with you. Some are pickier than others.

Allow me know in the comments if you know any other good options, or if you have whatsoever feedback near any of the ones I listed above!

How To Set Up A Us Bank Account From Overseas,

Source: https://nomadgate.com/us-bank-account-non-residents/

Posted by: arnoldgrack1969.blogspot.com

0 Response to "How To Set Up A Us Bank Account From Overseas"

Post a Comment